IMPORTANT INFORMATION

All data as at 31 December 2024, unless specified otherwise. This document is issued for information purposes only. It does not constitute the provision of financial, investment or other professional advice. We strongly recommend you seek independent professional advice prior to investing. The value of investments and the income derived from them may fall as well as rise. Investors may not get back the amount originally invested and may lose money. Any forward-looking statements are based on CCLA’s current opinions, expectations and projections. CCLA undertakes no obligations to update or revise these. Actual results could differ materially from those anticipated. All names, logos and brands shown in this document are the property of their respective owners and do not imply endorsement. These have been used for the purposes of this document only. CCLA Investment Management Limited (a company registered in England and Wales with company number 2183088), whose registered address is One Angel Lane, London EC4R 3AB, is authorised and regulated by the Financial Conduct Authority.

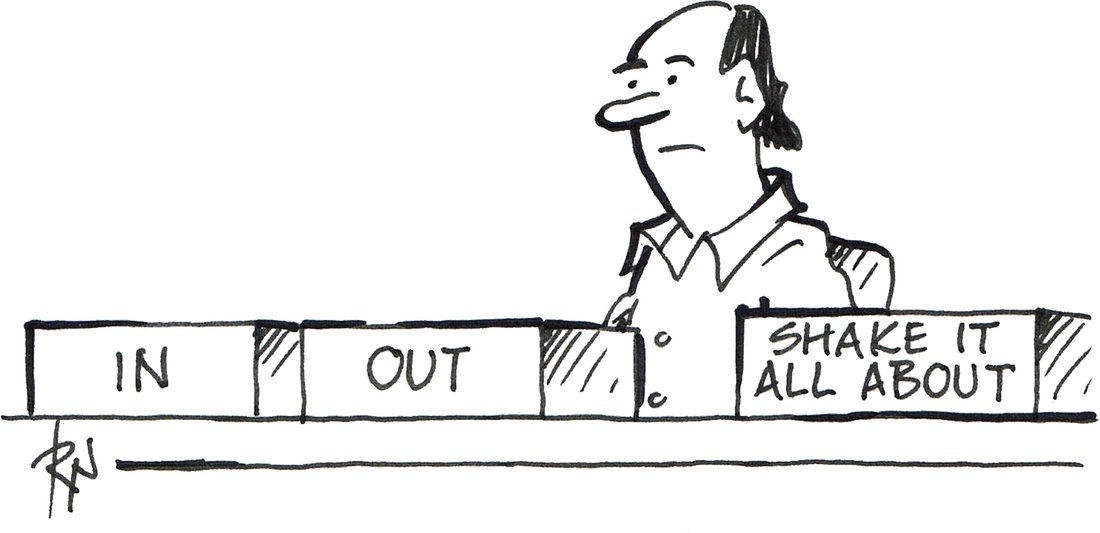

Ending the sustainability Hokey Cokey

Ending the sustainability Hokey Cokey

www.CartoonStock.com

As I come to review sustainable investment over the past year, I am reminded of a song called the ‘Hokey Cokey’. For those fortunate enough to be unfamiliar with this musical abomination, the song is about putting a part of your body (arms, followed by legs) in and then out repeatedly before having a shake and turning around. Quite frankly, it makes no sense.

Sadly, however, it is an apt metaphor for the investment management industry’s approach to sustainability. First, most firms were ‘out’, sustainability being seen as the preserve of a sandal-wearing minority. Then they were ‘in’, as sustainability began to emerge as the key to growing client engagement. Now, faced with a changing political environment in North America and the perception that clients no longer care, a whole lot are ‘out’ once again.

This is not just a damning indictment of our industry’s commitment to doing good. It is – to put it bluntly – quite dangerous.

At CCLA, we believe that investment markets can only be as healthy as the environment and communities that support them and that we need to do our bit to build a better world. This is not marketing rhetoric – it is a firm-wide recognition that sustainability matters. It is an understanding that, despite the noise, we are not in a good place. That continuing along the same unsustainable path will impact investment returns over the long term, and that the investment industry can play a role in building a better future. This is not altruism – it is essential if we are going to be able to continue to deliver financially for our clients.

I am deeply proud of the content of this report, which I hope provides a glimpse as to what we can achieve. In it you will find examples of how we – as a purpose-driven firm – are redoubling our efforts to drive change as others falter. You will see how we have continued to push the firms that we invest in to be a little bit better and, more importantly, you will find examples of how time and again they have responded positively to the challenges we have set.

However, I hope this report also shows that we cannot do this alone. To achieve change on the scale that is needed, we need others to join the charge. The path in front of us is daunting, but it is more achievable if we travel it together. So, as well as a celebration of what we have achieved, I hope this report will act as a rallying call to our industry to be better.

When it comes to sustainability, the investment industry needs to go beyond being ‘in’ and then ‘out’, and we must stake more than just an arm or a leg. Instead, we need to put our whole selves in and stay there. To properly serve our clients, we need to end the sustainability Hokey Cokey.

Peter Hugh Smith

Chief Executive, CCLA